The NFT and DeFi industry suffers the ravages of the cryptocurrency bear market, although it maintains higher numbers than the previous one of its growth.

The volume of NFTs (non-fungible tokens) in marketplaces is USD 189 million, according to data from the Dune explorer. This figure reflects that there is still a large flow of money in these assets, despite the fact that it is small compared to its best moment.

Records indicate that the all-time high volume for NFT marketplaces development was $1.805 million in August 2021. The low since then was $84 million in November 2022. That represented a 95% drop of which it has recovered slightly afterwards

These results show that the volume of NFTs in marketplaces increased slightly in December 2022, after hitting a year-and-a-half low the previous month. However, it is still far from its prime. Although, it should be noted, that the performance since then has been better than it was before the peak that began in mid-2021.

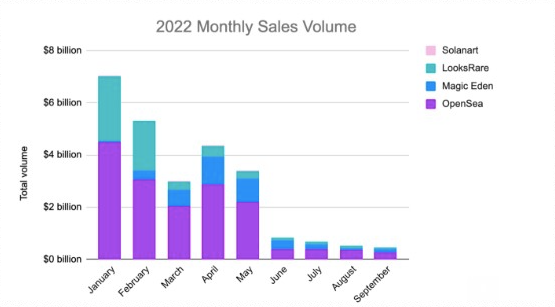

The high demand for crypto assets in 2021 led to their prices reaching their all-time high in that year, and NFTs were not out of this trend. Like bitcoin (BTC) and ether (ETH), NFTs boomed at such a time , which then fizzled out throughout 2022. An event that occurred in parallel to the crash of markets in general, such as stocks . stocks and stock indices .

The global economic instability of 2022 had a full impact on both traditional and non-conventional investment assets. Proof of the latest is CryptoPunks, the NFT collection with the highest volume on the market, whose transaction movement dropped from the all-time high of USD 44 million in August 2021 to USD 1.8 million at the end of 2022, according to data from DappRadar .

Now the NFT market is 3 times bigger than it was before its boom :

Despite this sharp decline in NFT volume, activity on its market has not fallen as much . In fact, it has reached its all-time high in January 2022 with 511,000 transactions and 255,000 traders, according to Dune. Then, such figures have dropped to around half, bottoming out in November, the month in which they increased slightly.

Shortly into 2023, the explorer shows that there are 262,000 transactions and 144,000 NFT marketplace platform development traders. These numbers, although they show a decline from the crest of the wave, are three times higher than those registered before the market boom in mid-2021. A panorama that indicates that interest in these assets continues.

In any case, it is prudent to consider that the number of traders may not be exact since Dune does not clarify where it takes its data from. In case it is based on how many existing NFT addresses there are, the number of traders could be less since each one can have more than one address .

The NFT collections with the highest volume are CryptoPunks, Bored Ape Yacht Club, Mutant Ape Yacht Club, Art Blocks, and Otherdeed for Otherside . These are the only ones in the market that by the end of 2022 register a volume of more than one million dollars each.

Bear market drags down NFTs and DeFi, but does not kill them :

The decline in NFT volume over the past year has paralleled that of DeFi (decentralized finance). According to blockchain explorer DeFiLlama , the amount of money deposited in DeFi contracts called “total value locked” (TVL), is down 78% from its peak .

Near the start of 2023, DeFi’s TVL is at $39 billion, which shows that there is quite a bit of money sitting in these assets. However, it reflects a significant drop compared to the historical maximum of USD 180,000 million that it registered a few days before the beginning of 2022.

In this way, the DeFi TVL is currently reaching its minimum of almost two years since February 2021 . Those with the most deposited value are MakerDAO and Lido with around USD 6 billion, followed by AAVE , Curve and Uniswap at around USD 3.5 billion each.

This scenario shows that DeFi has also been affected by the global bear cycle that continues to impact investment assets in general. In fact, its behavior over the last year has been very similar to the total cryptocurrency market.

According to explorer CoinMarketCap , the total cryptocurrency market capitalization is down 72% from its all-time high of nearly $3 trillion. Such a milestone was reached in November 2021, driven mainly by increased demand for bitcoin , and has since fallen to USD 810 billion today.

Despite this, the total capitalization of the cryptocurrency market is still higher than it was before the bull run that took it to its all-time high. And the same is true for both the value that is in NFT marketplace development service as well as in DeFi. Such a scenario indicates that their fall has not yet erased all the growth they did at their best .

Therefore, given a bull market recovery, we could see a bounce in assets in the cryptocurrency world in general. And that includes the DeFi and NFT industry which, despite the current down cycle, is still active and better than before its boom.